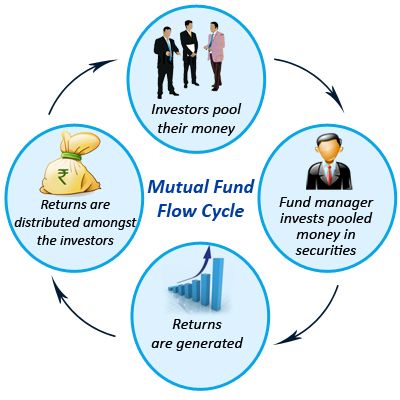

Mutual funds seek to mobilize money from all possible investors. Various investors have different investment preferences and needs. In order to accommodate these preferences, mutual funds mobilize different pools of money. Each such pool of money is called a mutual fund scheme.

Every scheme has a pre-announced investment objective. Investors invest in a mutual fund scheme whose investment objective reflects their own needs and preference.

Mutual fund schemes announce their investment objective and seek investments from the investor. Depending on how the scheme is structured, it may be open to accept money from investors, either during a limited period only, or at any time.

The investment that an investor makes in a scheme is translated into a certain number of ‘Units’ in the scheme. Thus, an investor in a scheme is issued units of the scheme.

Typically, every unit has a face value of Rs. 10. (However, older schemes in the market may have a different face value). The face value is relevant from an accounting perspective. The number of units issued by a scheme multiplied by its face value (Rs. 10) is the capital of the scheme – its Unit Capital.

The scheme earns interest income or dividend income on the investments it holds. Further, when it purchases and sells investments, it earns capital gains or incurs capital losses. These are called realized capital gains or realized capital losses as the case may be.

Investments owned by the scheme may be quoted in the market at higher than the cost paid. Such gains in values on securities held are called valuation gains. Similarly, there can be valuation losses when securities are quoted in the market at a price below the cost at which the scheme acquired them.

For running the scheme of mutual funds, operating expenses are incurred.

Investments can be said to have been handled profitably, with the following metric:

A) +Interest income (B) + Dividend income

(C) + Realized capital gains

(D) + Valuation gains

(E) – Realized capital losses

(F) – Valuation losses

(G) – Scheme expenses

When the investment activity is profitable, the true worth of a unit increases; when there are losses, the true worth of a unit decreases. The true worth of a unit of the scheme is otherwise called Net Asset Value (NAV) of the scheme.

When a scheme is first made available for investment, it is called a ‘New Fund Offer’ (NFO). During the NFO, investors get the chance of buying the units at their face value. Post-NFO, when they buy into a scheme, they need to pay a price that is linked to its NAV.

The money mobilized from investors is invested by the scheme in a portfolio of securities as per the stated investment objective. Profits or losses, as the case might be, belong to the investors or unitholders. No other entity involved in the mutual fund in any capacity participates in the scheme’s profits or losses. They are all paid a fee or commission for the contributions they make to launching and operating the schemes. The investor does not however bear a loss higher than the amount invested by him.

Various investors subscribing to an investment objective might have different expectations on how the profits are to be handled. Some may like it to be paid off regularly as dividends. Others might like the money to grow in the scheme. Mutual funds address such differential expectations between investors within a scheme, by offering various options, such as dividend payout option, dividend re-investment option and growth option. An investor buying into a scheme gets to select the preferred option also.

The relative size of mutual fund companies is assessed by their assets under management (AUM). When a scheme is first launched, assets under management is the amount mobilized from investors. Thereafter, if the scheme has a positive profitability metric, its AUM goes up; a negative profitability metric will pull it down.

Further, if the scheme is open to receiving money from investors even post-NFO, then such contributions from investors boost the AUM. Conversely, if the scheme pays any money to the investors, either as dividend or as consideration for buying back the units of investors, the AUM falls.

The AUM thus captures the impact of the profitability metric and the flow of unit-holder money to or from the scheme.

No comments:

Post a Comment