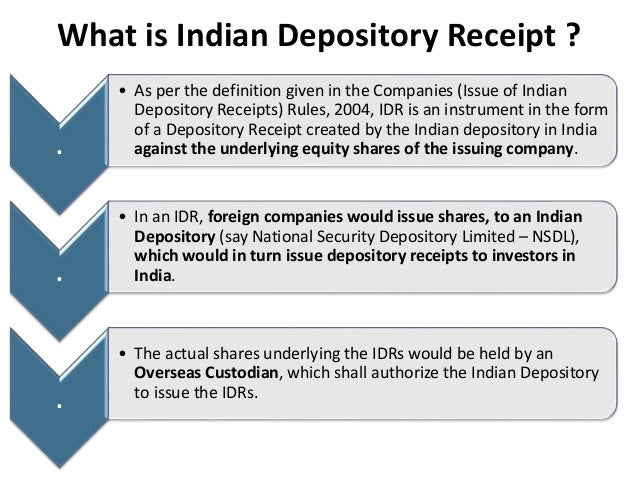

A foreign company can access Indian securities market for raising funds through issue of Indian Depository Receipts (IDRs).

An IDR is an instrument denominated in Indian Rupees in the form of a depository receipt created by a Domestic Depository (custodian of securities registered with the Securities and Exchange Board of India) against the underlying equity of issuing company to enable foreign companies to raise funds from the Indian securities markets.

An issuing company making an issue of IDR is required to satisfy the following:

(a) it should be listed in its home country.

(b) it should not be prohibited to issue securities by any regulatory body.

(c) it should have a track record of compliance with securities market regulations in its home country.

Conditions for issue of IDR.

An issue of IDR is subject to the following conditions:

(a) issue size should not be less than Rs.50 crore.

(b) procedure to be followed by each class of applicant for applying should be mentioned in the prospectus;

(c) minimum application amount should be Rs.20,000;

(d) at least 50 %. of the IDR issued should be allotted to qualified institutional buyers on proportionate basis.

(e) the balance 50 % may be allocated among the categories of non-institutional investors and retail individual investors including employees at the discretion of the issuer and the manner of allocation has to be disclosed in the prospectus. Allotment to investors within a category will be on proportionate basis.

Further, atleast 30% of the IDRs issued will be allocated to retail individual investors and in case of under-subscription in retail individual investor category, spill over to other categories to the extent of under-subscription may be permitted.

(f) At any given time, there will be only one denomination of IDR of the issuing company.

No comments:

Post a Comment