Any Market places where Buyers and Sellers participate in the trade of assets such as equities, bonds, currencies, derivatives , etc are called Financial Markets.

It may be a physical location like NYSE, BSE, LSE, ASE, NASDAQ, etc. It can be found in nearly every country in the world.

Functions:

a ) Facilitates the transfer of savings from Savers to Investors.

b ) Provides pricing information in the market.

c ) Provides liquidity to financial assets.

d ) Saves times, money and efforts of both buyers and sellers of assets.

Transactions in Financial markets is of 2 forms: Securities (stocks, bonds, etc) and Commodities (precious metals, agricultural products, etc)

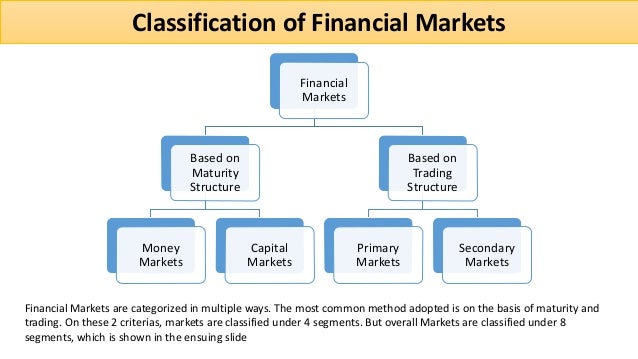

Types of Financial Markets:

A) Capital Market consists of Primary market [IPOs] and Secondary market [Stock exchanges] .

B) Money Market includes Treasury bills, Commercial paper, Call money, Certificate of deposit and commercial bills.

B) Money Market includes Treasury bills, Commercial paper, Call money, Certificate of deposit and commercial bills.

1) Stock Market is a market where you buy and sell shares in publicly traded companies.

2) Bond Market also called Debt, Credit or Fixed-income market is a security that investor loans money for a defined period of time at a pre-established rate of interest. It provides financing through issuance of bonds to enable the subsequent trading. These are issued by corporations, municipalities, states and federal governments.

3) Over-the-counter (OTC) is a type of secondary market where exchanging of public stocks not listed on NASDAQ, NYSE, ASE, etc.

4) Money Market trades highly liquid and short-term maturities which are borrowing and lending in less than one year. This includes certificates of deposit, treasury bills, promissory notes, commercial papers, banker's acceptance, etc..

Indian Money Market consists of Reserve bank of India, Commercial banks, Co-operative banks, Non - banking financial companies (NBFC) and Financial markets like LIC, GIC, UTI, etc.

5) Derivatives Market is a financial market that trade securities that derive its value from its underlying asset. E.g:- Forward Contracts, Future Options, Swaps and Contracts-for-difference.

6) Forex Market is a financial market where currencies are traded. It is the most liquid market in the world.

7) Spot/Cash Market is a market place for the immediate settlement of transactions involving commodities & securities. Prices are settled in cash on the spot at the current price market.

8) Interbank Market is the financial system and trading of currencies among banks and fiancial institutions excluding retail investors and smaller trading parties. These are trade by banks on behalf of customers.

9) Equity Market in which shares are issued and traded either through exchanges or over-the-counter markets. It is also known as Stock market.

10) Credit Market is a market place for the exchange of debt securities and short-term commercial paper. companies and government are able to raise funds by allowing investors to purchase these debt securities.

11) Commodity Market is a physical or virtual market place for buying, selling or trading raw or primary products. These are divided into Hard [natural resources that must be mined or extracted i.e gold, rubber and soil] and Soft [agricultural products , livestock].

No comments:

Post a Comment